The Importance of Safety Scores

On our last blog post we discussed the freight rate cycle, and how we can currently “guesstimate” that we are in the initial innings of the cycle, with most likely, a year or two of healthy rates going forward. This is great news for truckers out there, but sometimes in this environment we forget about things that can make a large impact on the bottom line, especially when rates come back down again, and I hate to tell you this, but they will. We are talking about safety record and scores which in turn impact insurance costs.

What happens is that when freight rates are high most trucking companies will make money, granted, in varying degrees of profitability, but still, almost everyone is making money. On the other hand when freight rates come down as they did in 2019, you’ll have three type of companies, some that are slightly profitable, some that are breaking even and the rest which are bleeding money, the trick is to try to have the lowest cost structure, because the companies that have the lowest cost structure are the ones that are going to be profitable and make it to the other side, while their higher cost brethren fall by the wayside during these downturns.

So if we look at the cost structure of a trucking company the two largest items are fuel and drivers, now here is the thing, most companies pay close to the same (per mile) in these two items, you could try to optimize somewhat but still, the difference is not going to be that large. Now the third item on that list in most cases is insurance (sometimes it’s repairs and maintenance and insurance is the fourth), but here we do encounter a great variability between companies. If we look for example at the largest slice of the insurance pie which is auto liability, over the years we’ve seen rates anywhere between $5,000 per truck per year to $30,000 per truck per year, yikes!!!

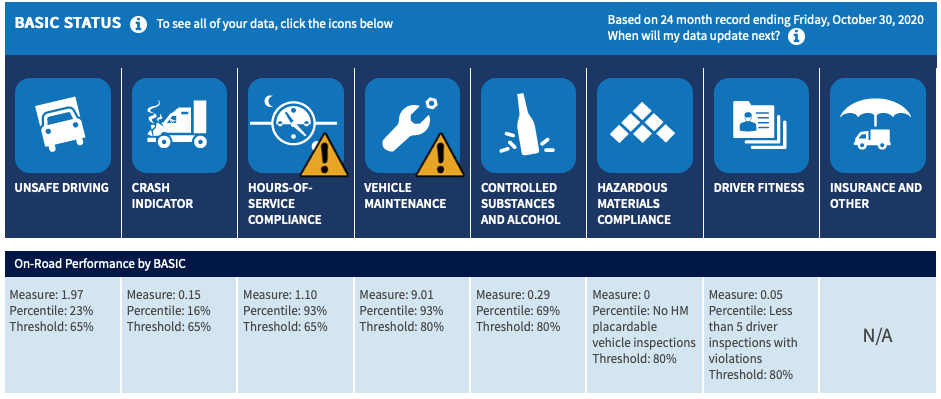

This is the reason why insurance is so important, even though it is typically the third or fourth largest cost item, it is the one with the greatest variability, and this difference is determined in large part by 2 factors: claims history and FMCSA safety scores, and if we look even closer we can note that although safety scores are by no means perfect, they are a decent leading indicator of future accidents. What this means is that we really need to keep an eye on our safety scores, and make sure they are trending in the right direction, we need to pay special attention to any possible alerts we might have in any of the categories, and take timely and appropriate corrective action accordingly. Below is a screenshot of a FMCSA score summary of a company with 2 categories in alert (HOS and Vehicle Maintenance) for your reference.

Let us know if we can help you in any way, our job is to get you the cash you need to run your business without worries so you can focus on what’s important for you and your business.